This VC roots for revolutionary deep tech, will Taiwan be their next stop?

Deep tech is bucking the trend of a “funding winter”. How can Taiwan businesses leverage the upticking deep tech developements amid this investment gloom?

One area of investment is bucking the “funding winter” downturn as warned by Sequoia Capital. Deep tech (or hard tech) has gained attention from investors due to its slow but steady growth amid a flurry of investment snowstorms that caused slumps in market valuation.

“Deep tech is the fundamental science that charts the path for new applications across multiple industries. Consider it a kind of ‘platform technology’, if you will,” said Dr. Michelle Kiang, co-founder of Impact Science Ventures (ISV).

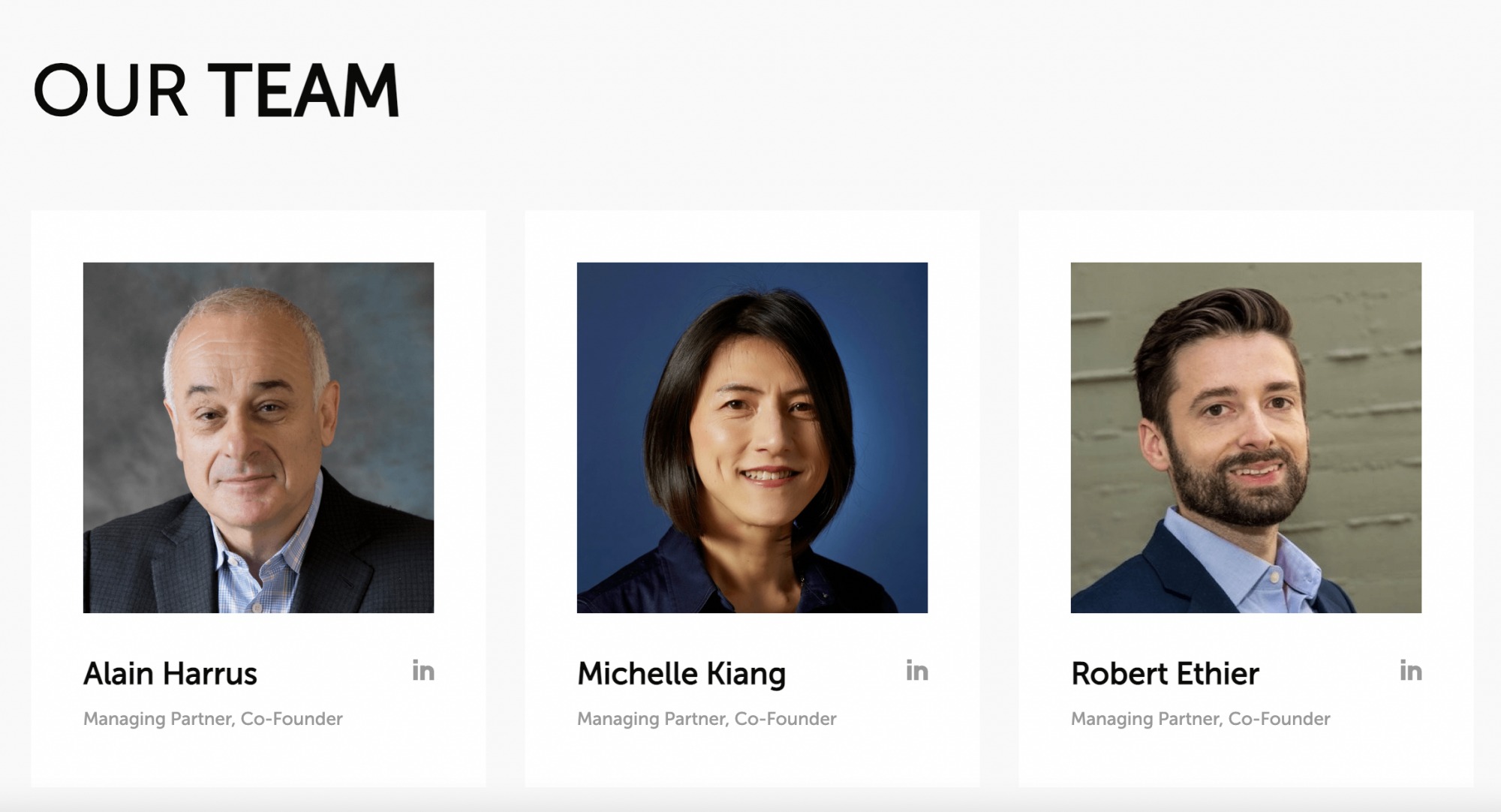

Founded in 2021, ISV invests in fundamental science breakthroughs across key impact sectors, including agriculture, semiconductors, manufacturing, energy, materials and biotech. The three founders of ISV, Michelle Kiang, Alain Harrus and Robert Ethier, combine their academic strengths, industry experience and investment expertise to scale deep tech startups.

Founded in 2021, ISV invests in fundamental science breakthroughs across key impact sectors, including agriculture, semiconductors, manufacturing, energy, materials and biotech. /Photograph : ISV

As a VC operator based in the US, Kiang’s ties with Taiwan may provide oppotunities for bilateral cooperation. Kiang is born-and-raised in Taiwan, she then went on to study Electrical Engineering at National Taiwan University, an academia that incubated many prominent figures including Barry Lam, founder of Quanta Computer.

A quantum physicist who got her Ph.D. from UC Berkeley, Kiang got her start in entrepreneurship shortly after grad school to commercialize her invention as part of her thesis and spent her early career building semiconductor and communications products as co-founder and CEO/CMO at a number of successful startups. She also held executive roles in strategy and corporate development at TDK, Micron Technology and NeoPhotonics.

Although there’s a longer return horizon for deep tech investments, it’s a niche for some investors— it’s an advantage only those with considerable industry experience and investment acumen can leverage. Once successfully commercialized, deep tech startups possess the revolutionary power to change the world. From silicon chips, artificial intelligence to solar tech, all of which are deep tech that has changed our way of life.

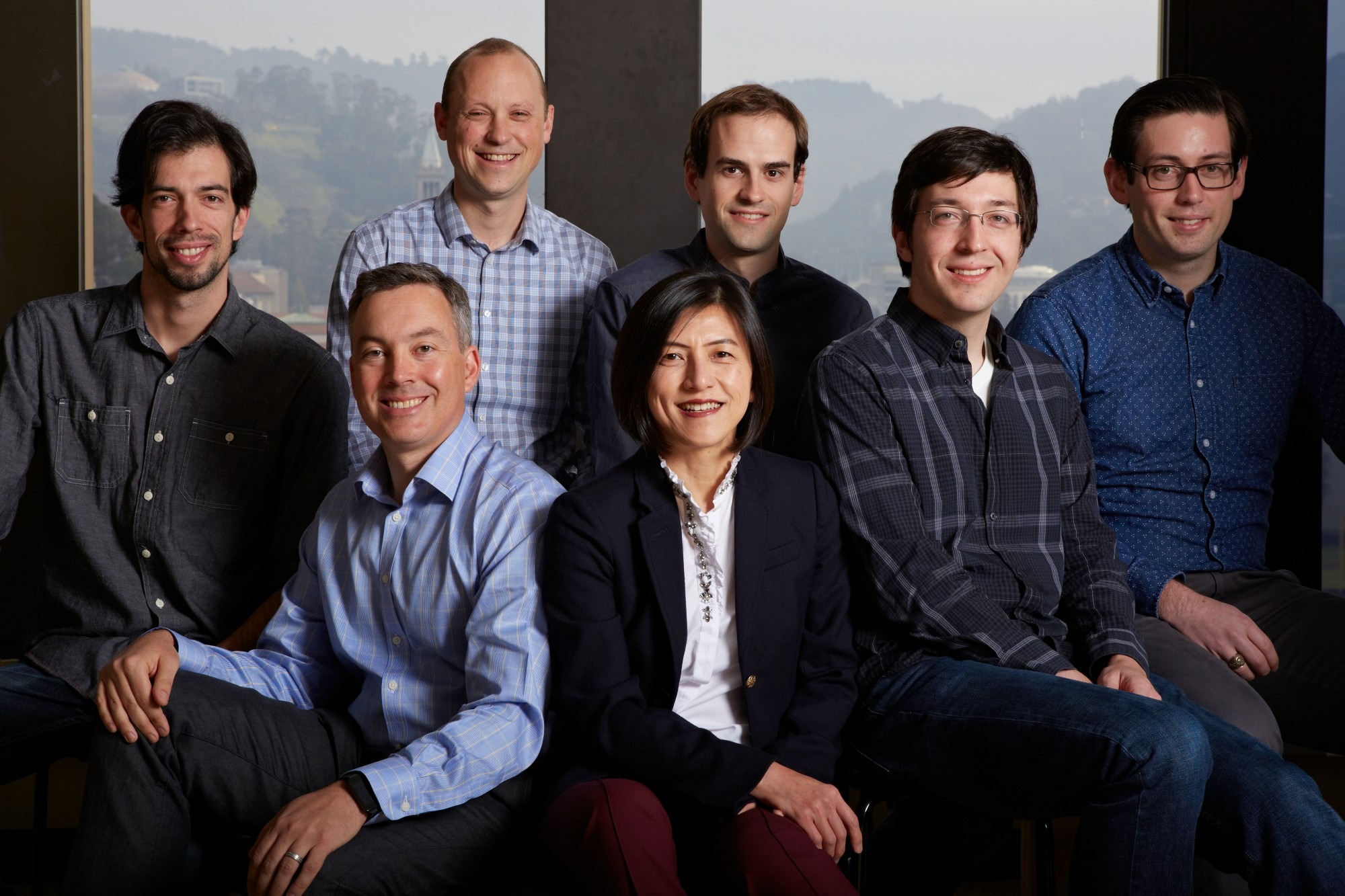

The initial Chirp team while they were at the UC Berkeley Skydeck Accerlerator Program. Kiang is a serial entrepreneur. Chirp Microsystems is one of her many co-founded startups, which was later acquired by TDK, the world's leading electronic component company. /Photograph : Michelle

Deep tech, not for the faint of heart

Kiang talked about how they came to focus on deep tech investment. “We believe major problems around the world will be solved by deep tech,” said Kiang firmly. That is, deep tech could have positive economic as well as social impact on the world.

Cohort companies of ISV include startups like UMARO (Open in new window) which looks to redefine plant-based food, Antora Energy (Open in new window) that decarbonized heavy industry with renewable heat, and Liminal (Open in new window) that seeks to help EV makers avoid costly battery recalls.

Founded in 2021, ISV invests in fundamental science breakthroughs across key impact sectors, including agriculture, semiconductors, manufacturing, energy, materials and biotech. /Photograph : ISV Official Website

It is not an exaggeration to say that the applications of deep tech is extremely extensive. Take the example of Antora Energy. Having successfully scaled, its decarbonizing thermal management solutions could be applied to heavy industries like cement, steel or petrochemicals, contributing to a greener Earth.

Deep tech and hard tech investment is far from a walk in a park. In the process of deep tech commercialization, scaling up is one hard job to get done. A much longer time frame is needed for deep tech to be commercialized, and a wide array of skill sets must be deployed.

“From one to one million. That is the tricky part,” said Kiang. Hard tech isn’t like software innovation or consumer products, where you could easily release copies of products or services. Hard tech innovation requires deeper due diligence tasks, heavier capital investment, and more time to grow into large assets.

ISV brought in advisors to make use of their field expertise, ensuring high-quality due diligence. Not only do the group of advisors provide key insights to the VC side, but they also give valuable recommendations to the startups in question to help them accelerate growth and achieve market success.

“We consider ourselves somewhat of an incubator program,” said Kiang. Being much more than a VC, ISV has now grown an outstanding portfolio that exerts a positive impact on the world.

As far as deep tech investment goes, there are three critical elements that make for a great one. The keys are “differentiable tech, hands-on industry experience and a good team,” according to Kiang. Take Antora Energy, a portfolio company of ISV, to illustrate.

Antora aims to stop climate change through affordable thermal energy storage system. Its tech is differentiable with other solar tech for its on-demand supply and affordability. As one Antora founder calls it, their tech is “hot as hell and dirt cheap”.

Moreover, the team behind Antora possess diverse experience which complements each other wonderfully. While two co-founders are fresh phD graduates, the other one is a startup veteran having founded a solar-tech startup prior to this experience.

Will Taiwan be the next stop?

Amid geopolitical tensions, Taiwan not only made its name to political headlines but also business front pages. What was mostly known to people outside Taiwan about the island is mainly its state-of-the-art semiconductor technology. But Taiwan has more to offer in terms of global business partnerships than that.

As a VC operator based in the US, Kiang’s ties with Taiwan may provide oppotunities for bilateral cooperation. / Photograph : Unsplash

Kiang shared some key insights on U.S.-Taiwan partnerships. It’s an unprecendented advantage for Taiwan amid geopolitical tensions, however, foreign VC funding still has not gained a full picture of Taiwan’s industry landscape and the opportunites it has to offer.

In the near future, Kiang looks forward to connect U.S. startups with Taiwanese businesses, and vice versa. Channels of investment also include government-funded VC projects. Prior to joining ISV, Kiang was a venture partner at Industrial Technology Investment Corporation (ITIC), a subsidiary of Taiwan’s Industrial Technology Research Institute (ITRI).

For those startups who seek funding from U.S.-based VCs, Kiang has pitched in some advice. First of all, it bodes well with VCs when startups aims at addressing global issues as opposed to local problems that will be hard to see extensive application. Furthermore, if a Taiwanese startup has already built connections with the U.S. market (i.e. established client ties), VCs will be more convinced to channel their funding energy into them.

To Kiang’s belief, Taiwan will be a major role in deep tech development. “I’m not saying that just because I’m Taiwanese,” said Kiang. It is her extensive expertise in the field that gave her the instinct to sniff out great opportunities in the world and for the world.

Source: Meet Global (Open in new window)