Insights into how these three Taiwan-based venture capitalists can shine on the global stage

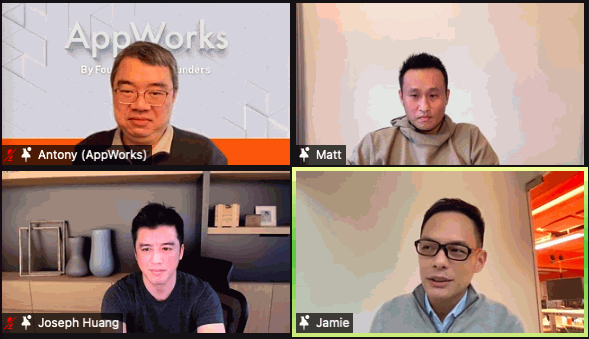

At the 10th AppWorks Media Meetup, three partners from global venture capital firms - Matt Cheng, founder of Cherubic Ventures, Joseph Huang, general partner of Headline Asia, and Jamie Lin, founder of AppWorks, joined together to talk about how they evaluate startups, and what advice they have for startups needing to raise money from VCs.

AppWorks, Headline Asia(formerly known as IVP), and Cherubic Ventures all gained stellar records for the past several years.

Last August, AppWorks just closed Fund III with USD $150M and brings AppWorks’ total assets under management to USD $212M. Currently, in the AppWorks ecosystem, there are 435 active startups, 1402 founders as AppWorks alumni, generating growing annual revenues at $13.9 billion in total.

Last May, Infinity Ventures and e.ventures rebranded as Headline, which made them become a team across Asia, the US, Europe, and Latin America for a combined asset under management of over USD $2 Billion.

Cherubic Ventures, established in 2014, has invested in over 200 startups, and their portfolio includes 10 unicorns, 28 startups valued over USD$100M.

Currently, in the AppWorks ecosystem, there are 435 active startups, 1402 founders as AppWorks alumni, generating growing annual revenues at $13.9 billion in total. / Photograph : AppWorks提供

At the 10th AppWorks Media Meetup, three partners from these VC firms discussed how they evaluate startups and shared tips on how they manage a successful VC firm.

Q. How would you describe the relationship between VCs and startup founders?

Matt Cheng: For Cherubic Ventures, we focus on investing in early-stage startups, so we participate from 0 to 1. We work with startups closely and provide them with advice.

Joseph Huang: It is like dating and getting married. VCs and startups need to keep finding a way to get used to each other, finding a way to support each other — just like how married couples need to find a way to live with each other.

Jamie Lin: It depends on what kinds of VCs and startups. Different stages of VCs have different goals, and different stages of startups need different resources. Echoing what Joseph said, the relationship between VCs and startups is like getting married, because once you’re married it’ll always be messy when you want to get a divorce later on, just like when VCs invest in a startup and you cannot just pull back the money at any time.

Partner of Headline Asia Joseph Huang feels the relationship between VC and startup is like dating and getting married. / Photograph : 賀大新攝影

Q. What factors do you consider before you invest in a startup? What has been your favorite investment deal in the past few years?

Joseph Huang: Kiwibot is an investment deal that we’ve made recently that I’m very proud of. It develops food delivery robots and over 50 US colleges are already using their services. I really admire the diligence and toughness the founder has as an entrepreneur. The founder shows no fear in the face of difficulties and perseveres in solving problems.

Matt Cheng: I’m very proud that we invested in Calm. The founder is a serial entrepreneur. When he was stressed, he relied on meditation to help him de-stress. He has always been practicing meditation and studying the science behind it but back at that time, people didn’t realize the potential of the mental health market. Founders of Calm met over 15 VCs at Silicon Valley but no one was interested. When I got a chance to chat with Calm’s founders, I could tell they are truly passionate about meditation and understand the positive impacts they could bring for others. When you truly love what you do, no matter what happens, you will keep going, and I knew they had the passion and ability to make it happen, so I invested in them immediately after meeting them in 2014. Now they have grown to a company with over 100 employees.

Jamie Lin: Mine would be Blocto. The cofounder Hsuan Lee was the former VP of Engineering for COBINHOOD, a company with lots of Taiwanese blockchain talents. AppWorks invested in Flow, and Flow wanted to find some Taiwanese blockchain talents to collaborate and build the Flow ecosystem into a better place. Hsuan Lee foresaw the potential and built a crypto wallet. With the experience from COBINHOOD, Blocto's crypto wallet is very user-friendly, and this is also the app I use every day.

Cherubic's founding partner Matt Cheng is proud of investing in Calm. / Photograph : 心元資本

Q. Tips for startups that are preparing to raise money?

Jamie Lin: Founders need to know why they want to raise money and what is the purpose of the money. Once founders get the investment money from VCs, they will demand a return, so founders need to make sure they have great ideas that will yield good returns. In addition, VCs are not all the same. Different VCs have different missions and provide different resources. Founders should do some research to make sure they are talking with the right VCs.

Matt Cheng: Founders shouldn’t wait until they need money to reach out to VCs. I met a lot of startups from Silicon Valley where no matter if you are interested in them or not, they would just keep sending you their company updates. By keeping in touch, VCs might start to get interested in you later on. Another tip is that I like to hear the disadvantages startups have. If they know their disadvantages, they can be careful about it and have more chances to succeed.

Q. There are some situations where popular startups get lots of potential investors. How do you win favor from startups and get the chance to invest in them?

Joseph Huang: Our advantage lies in our expertise and understanding of the Japanese market, so I will say to the founders that we are the best choice for you if you want to get into the Japanese market.

Matt Cheng: Because we focus on investing in early-stage startups, we are a founder-friendly VC. We will help founders grow, supporting them every step of the way, and because we have a strong network of founders across the world, we can help connect them to different founder communities and markets.

Jamie Lin: AppWorks has an accelerator, fund, and school, so these three pillars enable us to form a strong startup community. For example, when we invested in Flow, they told us they wanted to participate in our community and find the talents and resources they needed which we were able to provide.

〔Original :Meet Global〕

https://meet-global.bnext.com.tw/articles/view/47580